car lease tax benefit

This is applicable for self-employed as well as salaried professionals. 36 month leases starting at 519 mo.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

36 month leases starting at 439 mo.

. The actual benefits depend on the specifics of your business situation. Renting a vehicle in Piscataway has never been easier than it is now due to Auto Europes dedication to convenience and adaptability. You lease an electric car for 6000 over the 2022-23 financial year.

Its referred to as the motor vehicle sales and lease tax. Unlike in USA and elsewhere car lease in India is actually a hire-purchase scheme. Have your car delivered to your door.

Subaru Outback Lease Specials this Month. To claim car loan tax exemptions from Income Tax you need to show that you are using the car for legitimate business purposes and not as a personal vehicle. Be aware though that Section 179 can change each year or even mid.

To get a depreciation or Section 179 deduction you must use your car more than 50 of the time for business driving. If your business is a sole proprietorship filing Schedule C you can deduct mileage expenses for both leased and purchased vehicles. Save up to 30 with Secret Lease Offers.

That means you must pay this additional amount with the agreement. Corporations or partnerships must record actual auto expenses. Get a Subaru Lease for 36 Months.

Available vehicles depend on the policy used by the employer and may also include the option to trade up or down. Show you use the car for legitimate business purpose. Everything included except fuel.

Apart from the tax benefit there are more obvious advantages of. Use of the car up to your mileage limit. Leasing a vehicle could help you save as much as 30 on your taxes.

New Jerseys neighborhood new car and truck dealers represent the economic engine on Main Street. If you cant find what youre looking for on our site give us a call. BiK Tax doesnt apply to cars involved in ECO schemes.

Protect consumer safety by offering independent safety recall warranty and repair service. 200000 is your car lease amount and another Rs. Generate good-paying local jobs tax revenues and economic benefits.

2022 BMW 2 Series. FMC as lessor pay the dealer the 40000 balance. 350000 will be deducted from your taxable income and you will be liable to pay tax on Rs.

But leasing may get you Section 179 tax advantages. If employer pays for the cost of petrol use the rate of 055 per km instead of 045 per km. Call us now at 718 770-7980.

The value of benefit derived from an existing car with renewed COE is computed as follows. Section 179 of the Internal Revenue Code allows you to fully deduct the cost of some newly purchased assets in the first yearbut your company can also lease and still take full advantage of the Section 179 deduction. You can claim tax benefits only on interest.

It is 100 for a van but the government assumes you will spend 50 of your time and miles using your car for personal use. Get a Subaru Lease for 36 Mo. Unlike with some car schemes employees wont need to pay a deposit or initial payment.

So what is the big. 150000 is allocated towards car maintenance insurance fuel and driver allowance. And simplify the complex car.

Hire of the car. Out of this Rs. If you can show that isnt the case because the car lives at the office and is only.

We have a team of experts that are educated and well trained to address any of your questions or concerns regarding leasing a car. 37 x GDE 045 per km x private mileage if employee pays for the cost of petrol. The cost of your car lease through your limited company is a 50 offset against your annual tax.

In India there is no option - you must buy the car at the end of the lease at the 5 residual value. Pick Local Dealers Find Secret Specials. Right now you can use the BankBazaar website to lease a car from Revv.

They create fierce price competition and prevent manufacturer monopolies. The lease amount you pay for a vehicle is eligible for tax relief. Piscataway NJ car rental models.

If you use your leased vehicle for business purposes you can generally directly deduct the costs as business expenses monthly payments insurance mileage maintenance based on the percentage of business use versus non-business use. Other benefits to leasing include not having to worry about depreciation fixed assets and capital allowances. You can only claim car loan tax benefits on the interest and not the principal amount.

Car lease options in your city. Ad Request a Lease Quote on Any Car. You deduct the cost against profits.

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of leasing can be deducted from taxable profits if the vehicle is considered a company car. AA breakdown cover roadside assistance on your doorstep and away from home. The lease terms are.

Up to 3 cash back At the downtown and throughout the city Budget and Avis car rental locations are available. Stay flexible thanks to short terms. Is leasing a car a tax deduction.

36 month leases starting at 1099 mo. Please contact us to learn more and to get the best car lease deal today. Find Car Leases Online Low Prices.

The buy option at the end of lease is also available abroad but it is an option. RCW 82090203 in Washington State requires an additional tax of 03 on the sale or lease of all motor vehicles. Flexibility at the end of the contract.

Ad Subaru Outback Lease Specials this Month. Our services are also available in New Jersey Connecticut and Pennsylvania. The lease payments are calculated so that over the three-year term they equal 40000 minus the residual value at the end of the lease plus interest on the difference.

Mileage or term adjustment you can request a single change to either the mileage or the term period at any time during the term without an administration fee. As corporation tax is 19 then your tax savings are calculated as 19 x 6000 1140. For this reason and because tax.

The residual value is calculated as 4688 of 40000 18752. Ad Monthly fixed price with no down payment hidden fees. As previously mentioned business leasing can provide considerable tax benefits.

Some states require you to pay an additional tax on a car lease.

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How To Write Off A Car Lease For Your Business In 2022

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

How Does Leasing A Car Work Earnest

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Is Your Car Lease A Tax Write Off A Guide For Freelancers

New Car Lease Incentives What Are They And How Can They Save You Money Capital Motor Cars

![]()

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

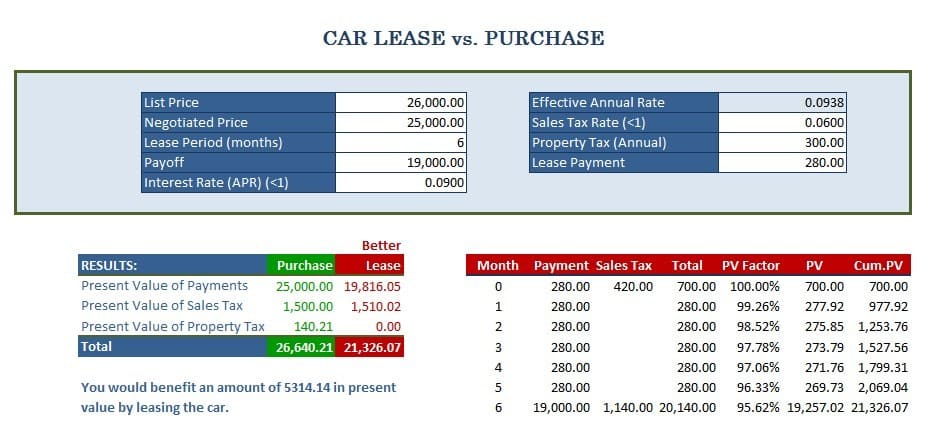

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Buying Vs Leasing A Car Pros And Cons Of Each

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Buying Vs Leasing A Car Pros And Cons Of Each